RTO

Talium Assets for your royalties

RTO – Royalty Token Offering

Revenue Based Financing 2.0

A new alternative financing model. Tokenized for liquidity.

Revenue based financing (RBF) raises capital in return for a revenues % during a given period until it repays N-fold -or longer until recoupment.

Non dilutive

No debt

Low risk

RBF is especially interesting if visibility on revenues is good: scenarios with regular income (SaaS, rentals…), business plans validated through due diligence and/or scoring…

Major extra RBF pain points :

- Liquidity: the lack of a secondary market makes it very difficult for an investor to resell his investment.

- Automation: end-to-end process automation increases productivity while reducing costs and error rates.

RTO = Crowdfunded & Tokenized RBF

- 1 – investors provide funds to the company

- 2 – investors receive rights to royalties (tokens)

- 3 – Customers pay the company for services

- 4 – X% pays the investors pro rata their tokens

- 5 – Investors can trade their royalties

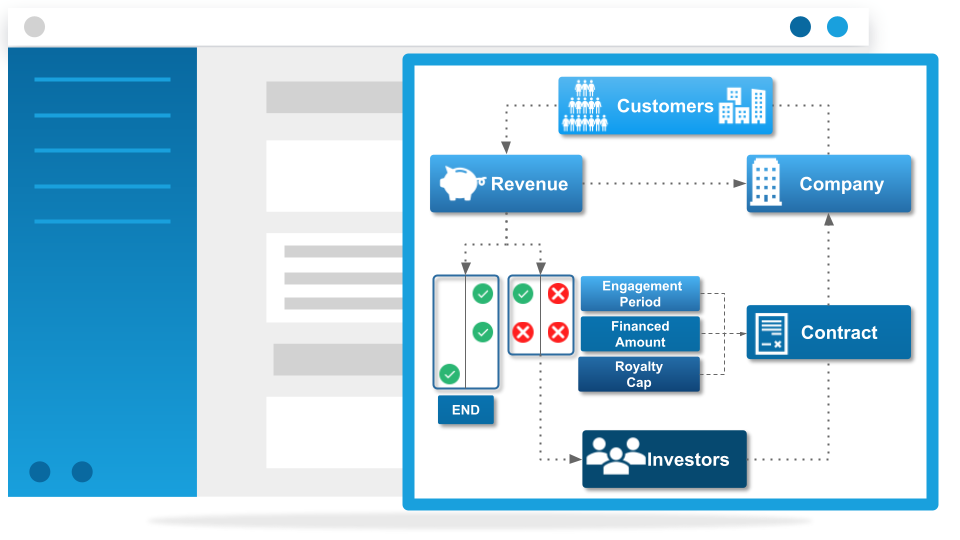

For every investor, the royalties are ruled by a formal contract, which ends when either one of the following 3 scenarios occurs:

1 - The royalty cap is reached

2 - The engagement period is over and the investor has recovered at least its financed amount

3 - The engagement period is prolonged beyond its initial setting until the investor has recovered its financed amount

Extra Talium Assets features:

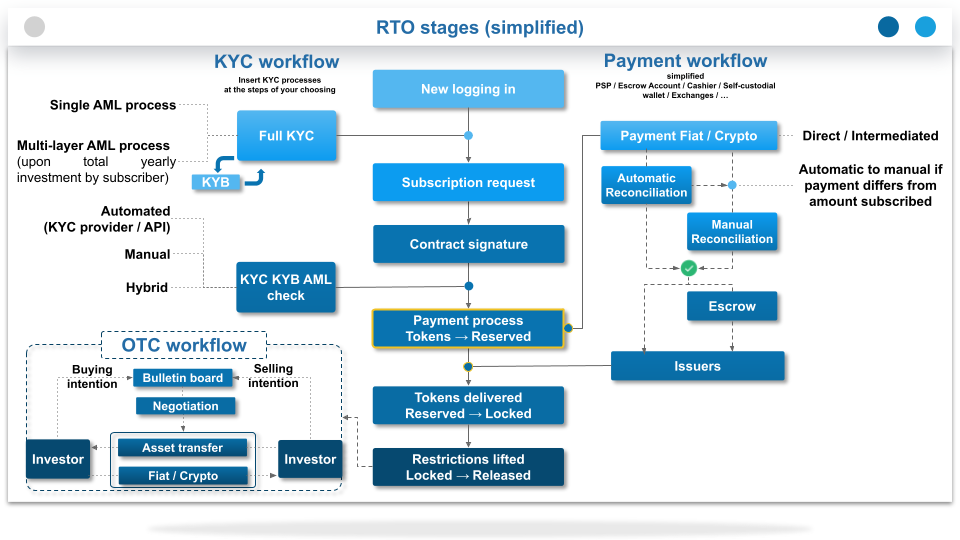

- OTC trading via bulletin board

- Real-time compliance with regulations & asset holders’ agreements, with rule engine

- Tokenize on 30+ blockchains and change at will

- Token recovery procedure

- Adaptive KYC procedures

- Automated reconciliation