Last Updated on December 8, 2020 by Talium

In France, the DEEP (Dispositif Électronique d’Enregistrement Partagé: electronic shared registration system in English) enables joint-stock companies to record their share movements in a decentralized register (e.g. blockchain). This simplifies the process and saves the intermediation costs related to account keeping/custody.

Let’s define the electronic shared registration system and securities movements

The world of fintech encompasses a wide variety of terms. In order to better understand the subject we are dealing with in this article, we propose a few definitions.

The blockchains & DLT, parents of the DEEP

The term DEEP (Dispositif Électronique d’Enregistrement Partagé)was used for the first time in 2016 in article 2 of the ordonnance n° 2016-520 du 28 avril 2016 relating to cash vouchers. This is the “Minibons” ordinance, which allows the issuance and circulation of debt instruments on a blockchain, or equivalent technology. The definition of a DEEP is not limited to a blockchain.

DEEP is an abstract and agnostic notion of the technologies used to implement it, such as Decentralized Ledger Technologies(DLTs), of which the blockchain is a part.

A shared registry is a repository registered and synchronized on several nodes (computers) that evolves with new data validated by the network, which can never be deleted.

The blockchain is part of the DLT family and is often named as a single example, by shortcut.

Figure 1 : How a shared registry works

On December 24, 2018, decree no. 2018-1226 relating to the use of a DEEP for the representation and transmissionof financialsecuritiesand for the issue and sale of minibons appears. It legally recognizes the possibility of digitizing not listed financial securities on a DEEP.

The register of securities movements, an indispensable element for joint-stock companies.

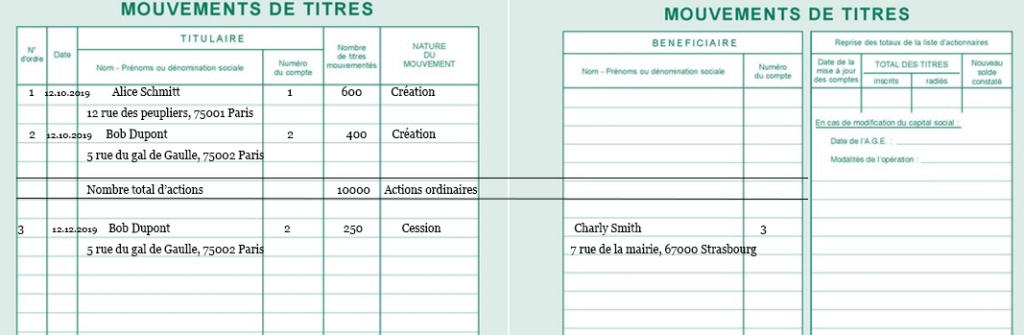

The securities movement register groups together all transfers of shares and/or other securities issued by a company (e.g. share purchase warrants). Even if the law does not provide for sanctions in the event of the absence of this register, it is nevertheless indispensable. Indeed, the French Commercial Code states that the transfer of ownership of a share can only be valid if it is recorded in a register. It should be noted that the creation of the company leads to the first movement of the allocation of shares to the first shareholders.

The following information must appear for each movement :

- The dateof the transaction

- The surnames, names, and domicile of theformer and new holders of the shares (or company name, identification number and registered office for legal entities), in the event of a transfer or in the event of conversion of bearer shares into registered shares (note that in this case, the holder does not change) ;

- The par value and number of securities transferred or converted. However, when these securities are shares, the share capital and the number of securities represented by all shares of the same class may be indicated instead of their par value ;

- Where applicable, if the company has issued shares of different classes (e.g. normal shares and preference shares) and if only one record of registered shares is kept, the class and characteristics of the shares transferred or converted ;

- A serial number assigned to the transaction.

This register can be in paper form, digital file (e.g. ‘Excel’) or any database; and from the ‘minibons’ order on a DEEP, such as a blockchain.

Figure 2 : Example of a securities movement register.

Why is it preferable to use the DEEP for recording stock movements?

The main advantages are based on the reduction of intermediaries and, ultimately, costs.

Cost and speed

In general, the company may decide to hold its shares in bearer or registered form (administered or pure). In the case of bearer shares or administered registered shares, this requires going through a financial intermediary, the custodian account holder, which charges custody fees.

In the case of pure registered shares, it is the company that holds the register.

Keeping a register on a DEEP often speeds up the share transfer process (transfer/acquisition). The DEEP also makes it possible to dispense with financial intermediaries. Thus, the company can choose to hold its shares in pure registered form and easily manage its ledger

Liquidity or fractionability

Liquidity is the ability to buy or sell an asset without affecting its price.

It is not the DEEP itself that brings liquidity, but the opening to the world market, due to the availability of the DEEP on the Internet. Assets can easily be split. Thus certain types of investments usually reserved for large investors (e.g. real estate) are now available to other categories of investors.

Quality and traceability of transactional data

The blockchain is completely transparent, which means that the data can be checked at any time. It allows for real-time financial indicators using tools such as glassnode. Due to its immutable and non-repudiable nature, the blockchain allows constant traceability of data. The use of the DEEP makes it possible to fight against money laundering and terrorist financing. We can take the example of Chain Analysis, which, among other things, makes it possible to track each transaction.

Automation

Thanks to the Smart Contracts technology, enabled by the blockchain, the verification of the transferability rules of an asset can be automated. This reduces compliance costs related to the regulations and contracts to which assets are subject This automation prevents systemic risks, such as counterparty risks, without the need for a clearinghouse. It is the code that allows the transfer of the share only if the payment is well received. The DEEP thus makes it possible to separate from a second intermediary, which results in a reduction in costs.

Compliance

The laws surrounding new technologies are changing rapidly around the world. It is important to choose the technology that allows continuous compliance. The Talium Assets platform provides you with an infrastructure that allows you to configure the compliance rules related to your industry, AML, LCB-FT, shareholders’ agreement, etc. With this system, you are assured of 100% compliance at all times.

References

Minibons, titres financiers et blockchain, Mathias avocats

Ordonnance blockchain sur la transmission d’actifs financiers, Marie-Adélaïde de Montlivault-Jacquot

Le registre des mouvements de titres en SA et SAS, Pierre Facon